Inflation in Austria has cooled from its post-pandemic peak, but it remains stubbornly higher than the EU average. While much of Europe is returning to price stability, Austrian households continue to feel that everyday life — from energy bills to services — costs more than it should. The question is no longer whether inflation is falling, but why Austria is falling more slowly than its peers.

Recent figures confirm that Austria’s consumer price inflation stood at 3.8% at the end of 2025, a level that remains well above the European Central Bank’s 2% target and higher than many euro-area countries (RTT News, Trading Economics). In a eurozone where inflation is steadily converging toward normal levels, Austria continues to run “hot”.

Part of this is statistical. In 2025, Statistics Austria revised the inflation “basket”, changing how everyday spending is weighted — a move that subtly reshapes how price pressures appear in official data (Kleine Zeitung). While this improves accuracy, it does not explain the lived reality: Austrians still pay more for essentials than their European neighbours.

The Oesterreichische Nationalbank (OeNB) points to two core drivers: energy and services. Austria removed electricity and gas subsidies earlier than some EU peers, causing a sharper rebound in household bills. At the same time, strong wage growth and high demand in tourism, hospitality, and personal services have kept services inflation elevated (OeNB Economic Outlook). These domestic pressures are harder for central banks to cool — and they linger even when global energy and food prices stabilise.

By contrast, much of the EU has benefited from faster pass-through of falling wholesale energy prices and tighter fiscal policy. The European Commission expects euro-area inflation to approach target levels sooner than Austria’s, reflecting more subdued domestic price dynamics elsewhere (European Commission Forecast).

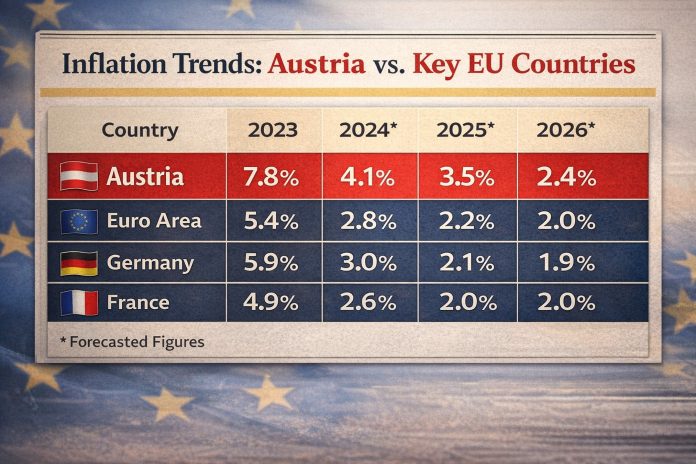

Austria is not stuck in high inflation forever. Forecasts suggest a gradual convergence: inflation is expected to fall toward 2.4% in 2026 and 2.2% in 2027 (European Commission Forecast). But “gradual” is the key word. For households, this means that real purchasing power continues to be squeezed for longer than in neighbouring states.

The social consequences are tangible:

- Rent, energy, and service costs erode middle-class security.

- Wage increases struggle to keep pace with living costs.

- Savings lose real value faster than in lower-inflation EU economies.

Austria’s dilemma is structural. Monetary policy is set in Frankfurt, not Vienna. If Austria’s inflation is driven by domestic pricing dynamics, then the solutions must also be domestic: stronger competition in services, smarter energy pricing, and more targeted support that cushions households without reigniting price pressure.

Inflation is no longer a European shock — it is becoming a national test. Austria’s challenge is to ensure that “normalisation” does not arrive years later than elsewhere. If it does, the country risks drifting into a quiet but corrosive reality: living in one of Europe’s most prosperous economies, yet paying persistently more than its neighbours for the same life.

If you notice any inaccuracies in my writing, please get in touch with me. I will be happy to correct it.